|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Average Home Refinance Interest Rate and Its ImplicationsWhat is a Home Refinance Interest Rate?The home refinance interest rate is the cost of borrowing when you replace your existing mortgage with a new one. This rate influences your monthly payments and the total interest paid over the loan's lifespan. Understanding these rates can help you make informed decisions about refinancing your home. Factors Affecting Refinance Interest RatesCredit ScoreYour credit score is a significant factor that lenders consider. A higher score often results in lower interest rates, making refinancing more cost-effective. Loan TermChoosing between a 15-year or 30-year term can affect your interest rate. Generally, shorter terms come with lower rates. For instance, you might find competitive 15 year refinance rates in Massachusetts that offer substantial savings over time. Market ConditionsCurrent economic trends, such as inflation and Federal Reserve policies, also play a role in determining average refinance rates. Staying informed about market changes can help you decide the best time to refinance. Benefits of Refinancing Your Home

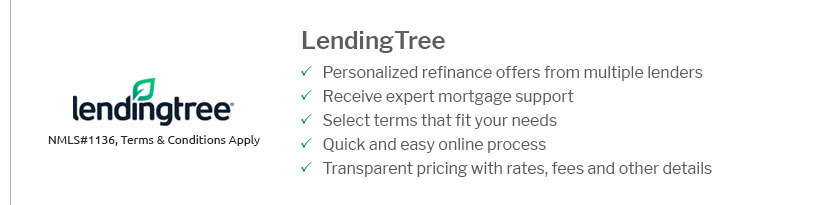

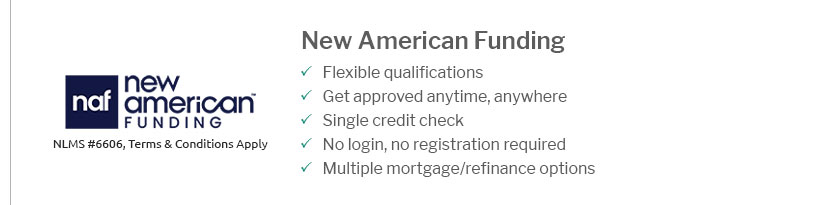

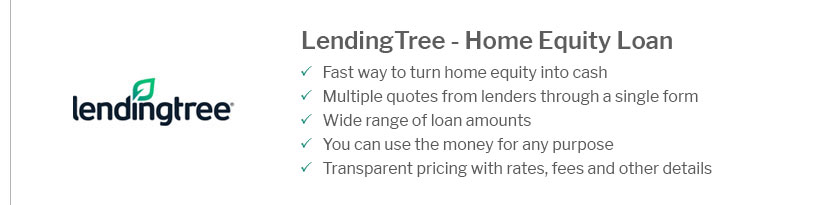

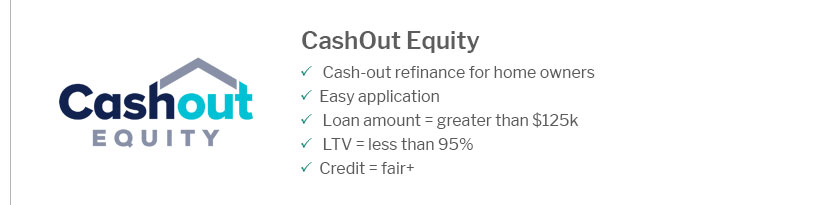

Choosing the Best Company for RefinancingFinding the right lender is crucial. Many factors, such as customer service, rates, and terms, should be considered. Researching can lead you to the best company to refinance your home that fits your needs. FAQ Section

https://www.zillow.com/refinance/

The current average 30-year fixed refinance rate remained stable at 6.72% on Wednesday, Zillow announced. The 30-year fixed refinance rate on January 22, 2025 ... https://money.com/current-mortgage-rates/

Average mortgage and refinancing rates for January 24, 2025 ; 7/1 ARM. 6.534% 0.028% ; 10/1 ARM. 6.896% 0.045% ; Average mortgage refinance ... https://www.investopedia.com/today-s-mortgage-refinance-rates-by-state-jan-2-2025-8768295

The Washington, D.C. average was 7.11%. ... Mortgage refinance rates vary by the state where they originate. Different lenders operate in ...

|

|---|